-

My wife bought out her hybrid lease a few weeks ago just before the crunch hit, glad she did. We can go from Buffalo to central Long Island on one tank.

-

03-09-2022 02:26 PM

-

I continue to drive my 2015 Scion FR-S. I suspect it will be the last car I buy for myself, since my wife and I could get along with one car very nicely. I've been a car guy my whole life - building, restoring, racing, buying and selling. I love my traditional, mechanical, simple, bare bones little car and do not want one that shuts off and restarts at every red light, sounds like a lawnmower, can only be repaired by replacing what goes bad, and has the personality of a turnip. The FR-S (and its badge buddy the Subaru BRZ) are as close to the feel and personality of the five 356 Porsches I've had since 1966 as any modern car. I love it!!

I've driven enough electric cars to know that they can be exciting. I've rented a few Prius models while on vacation, to see what they were like. I test drove a Nissan Leaf and a few Teslas, including a Ludicrous - and those suckers are fast! They handle fine and are fantastic in the worst weather. Maximum torque of an electric motor occurs at 0 RPM, so they leave the line like a stone pick striking a string. They are not even completely silent - they just lack an exhaust note (which I will miss, since I love the sound of a well tuned, powerful IC engine). So even though my buddies all hate the very thought of driving one, I think I'll be OK with one.

Still and all, as long as I can keep the Scion (now a Toyota) running without major expense and hassle, it's my baby. It's paid for - and I can get a guitar, an amp, a keyboard, and a few gear bags in the trunk with the rear seat up.

-

Here's another... this one says 40%, and they are talking about money that was actually printed:

If you add up all of the money the U.S. has ever printed… over 40% of it was printed in 2020 alone.

That is not a typo.

Patrick Bet-David pointed this out and he’s right: if you add up all of the money the U.S. has printed since its founding… over 40% of it was printed last year.

Bear in mind, we’re talking about money that’s actually printed, NOT issued as credit or loans (the mechanism through which most “money” enters the system today). So, we’re talking about actual cash that goes into the economy.

How Much Money did They Print Last Year?! | Money & Crisis

-

You and they may think they are, and they may be intentionally distorting the facts. In either case, this is simply incorrect.

Originally Posted by ruger9

Originally Posted by ruger9

They are referring to the money used by the Fed to buy bonds. None of this was printed and no cash money changed hands - it was a series of digital transfers that resulted in higher bond prices and stabilization of that market. They successfully preserved and enhanced the value of that market by buying treasury securities and bonds with the promise of payment even if they failed. But they succeeded, and no new money will have entered circulation from this effort.

The fed sells off those bonds as pressures ease, and that’s what’s happening now. They will recover their costs plus the appreciated value that resulted from their purchases. If you or I did this, it would be called wise investing. Here’s a WSJ article explaining more.

I give up. Believe what you wish to believe, but these are the facts.

-

I'm still driving a 1994 Acura Legend, but it's so clean I get mechanics asking to buy it. I'll swap in a new engine and tranny before I sell it. Especially these days. 145K miles and still rarely a problem.

-

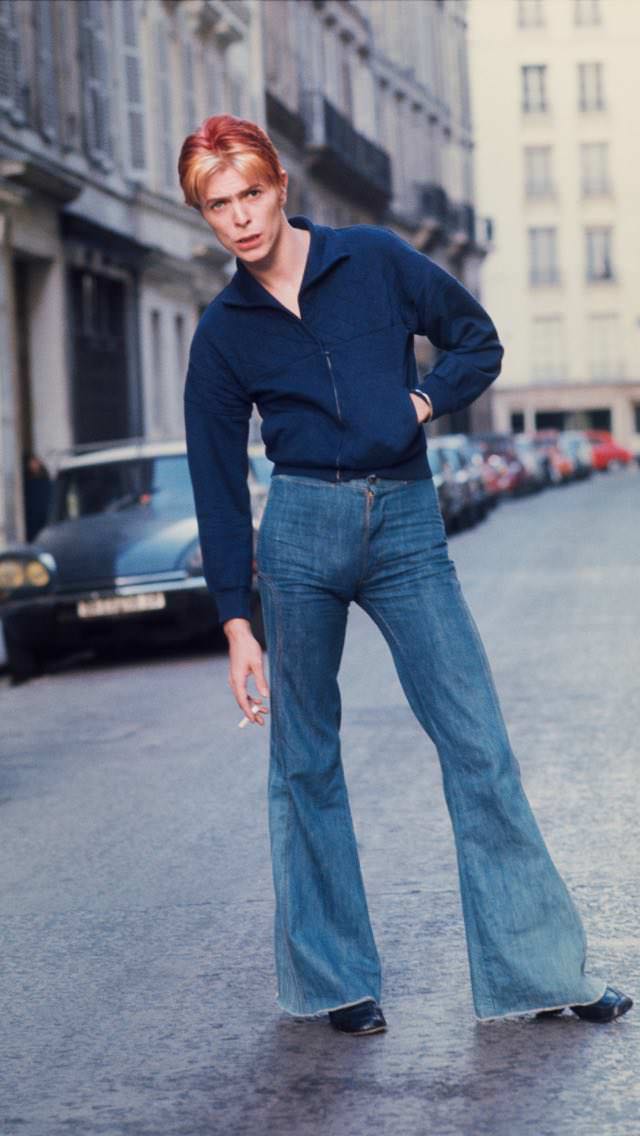

Well you're not gonna see it on the Osmonds, but the important part with the pants was to get the bulge on the right side.

Originally Posted by nevershouldhavesoldit

Originally Posted by nevershouldhavesoldit

-

BTW, I don't remember my dad or mom or their friends complaining constantly about the price of stuff, though there were those songs like "the price of meat has just gone up and your old lady has just gone down" and "can't afford a gallon of gas".

Actually gas was the one thing that made my dad change his game. In 1972 he got a new Datsun stationwagon for driving the 20 miles to work, instead of the old gasguzzling Bonneville. Otherwise, for most people inflation, and its cure high interest rates, was just something you accepted, like chickenpox or menopause.

Car inflation is now on par with the mid-70's/early 80's, though that streak lasted about a decade, and we're only 2 years into the current one. Nothing like 50% price inflation in 1947 though!

Vehicles price inflation, 1935→2022

-

WITH all due respect... I am not an economist, are you? (maybe you are)...

Originally Posted by nevershouldhavesoldit

Originally Posted by nevershouldhavesoldit

...but there's alot of sources disputing YOUR "facts"... which just comes back around full circle to the same thing I have been saying in all this political threads: NO one source can be trusted. They all give their perception of truth. They all "arrange" statistics and facts to tell THEIR story. I would love to read an actual, objective, truth. I don't think it exists. On anything. Like "Putin invaded Ukraine because he's evil and wants the USSR back" lol. Anyone who thinks this is that cut-and-dried, isn't paying close enough attention. Same goes for the economic stuff- money printed, bonds sold, TRILLIONS in "bail out" for Covid, etc...

So even if a source exists that can show how much NEW money was "created" out of whole cloth (and I don't know enough about economics to know if the bonds and other "securities and whatnot" count or not), I'd love to see it... but as it equates to inflation. Because basic economics still dictates, the more money there is, the less it's worth. At least since going off the gold standard. Printing too much money causes inflation. It's happened over and over again throughout history. (and yes, I know the Fed and intrest rates, etc. all play a role. My entire point is, all the money recently printed IS playing a role in the current inflation.)

But this is a thread about car prices, so at this point, we'll have to agree to disagree (you can also "believe what you want") and leave it at that.

-

I definitely do. I remember Jimmy Carter's gas lines.

Originally Posted by Doctor Jeff

Originally Posted by Doctor Jeff

-

Actually the gas lines were in the Nixon and Ford administrations. Maybe you remember Ford's Whip Inflation Now buttons? Carter did take office during a period of stagflation and installed Paul Volcker as Federal Bank chair. Volcker's push for high interest rates brought down inflation after several years, but not before leading to a recession that hurt Carter's reelection chances.

Originally Posted by ruger9

Originally Posted by ruger9

I don't remember any gas lines ever from our neck of the woods in Chattanooga. Probably more of a big city thing.

-

Nope - just an MBA. None of what you're concerned about causes inflation - propping up bond prices lowers interest rates, and the profit made by the Fed on these transactions reduces the deficit.

Originally Posted by ruger9

Originally Posted by ruger9

Back to cars...

-

The Fed is not printing money. It is buying, on international markets, securities that it created, to put money into the American economy.

Originally Posted by ruger9

Originally Posted by ruger9

Bloomberg, today:The largest Federal Reserve bond-buying program is about to come to an end.

With the U.S. central bank having bought close to $6 trillion of Treasuries and mortgage bonds in the past two years after the onset of the Covid pandemic rattled markets, this Wednesday’s $4.025 billion operation looks set to be its last in Treasuries, with mortgage operations running through the end of the week.

The Fed explains:

Is the Federal Reserve printing money in order to buy Treasury securities?

No. The term "printing money" often refers to a situation in which the central bank is effectively financing the deficit of the federal government on a permanent basis by issuing large amounts of currency. This situation does not exist in the United States. Global demand for Treasury securities has remained strong, and the Treasury has been able to finance large deficits without difficulty. In addition, U.S. currency has expanded at only a moderate pace in recent years, and the Federal Reserve has indicated that it will return its securities holdings to a more normal level over time, as the economy recovers and the current monetary accommodation is unwound.

Although Federal Reserve purchases of Treasury securities do not involve printing money, the increase in the Federal Reserve's holdings of Treasury securities is matched by a corresponding increase in reserve balances held by the banking system. The banking system must hold the quantity of reserve balances that the Federal Reserve creates.

Ordinarily, an increase in reserve balances in the banking system would push down current and expected future levels of short-term interest rates; such an action would serve to boost the economy and variables like bank lending and the money supply. If maintained for too long, a relatively high level of reserve balances and a low level of short-term interest rates could lead to the buildup of inflation pressures. However, with short-term interest rates already near zero, an increase in reserve balances by itself cannot push short-term interest rates much lower. As a result, the current elevated level of reserve balances has not generated an increase in inflation pressures. However, the Federal Reserve monitors inflation and inflation expectations carefully and is prepared to take appropriate actions to adjust policy so as to foster its dual mandate.

Things did not work out as they expected.

-

Why just the right side? Mine takes up *both* sides.

Originally Posted by Doctor Jeff

Originally Posted by Doctor Jeff

-

So, 'Profit made by the Fed ' for issuing worthless paper securities to subsidize the bond market reduces the deficit ?...or maybe put another way :

Originally Posted by nevershouldhavesoldit

Originally Posted by nevershouldhavesoldit

A kid comes home from school one day and tells his Mom: " I saved fifty cents all by himself today ! "

And his Mom says : " How'd you do that ? "

And the kid says " Well, instead of taking the bus home like always, I ran behind it and saved fifty cents ! "

And his Mom says : " Well, geez,why didn't you run behind a taxicab and safe twenty bucks - -we could use the money !! "

Apply the joke to the political party of your choice....and take note of who 'gets it' and who doesn't..... : )

-

This is a camel-toe free zone here. No pics please.

Originally Posted by Woody Sound

Originally Posted by Woody Sound

-

Still driving my 2000 Honda Accord with 286k miles. Still runs great. I do need to replace it but will wait until things settle down (if they ever do).

-

The Fed did issue those securities, but not for this purpose - and they were / are far from worthless. When issued, they were sold to market makers and groups of investors for real honest-to-goodness money - and their resale value on the secondary market was determined by supply and demand. They bought them back at depressed market prices for the program that has you so upset, and that stablilized the secondary market and even drove prices back up a bit. When they then sell them back into the market at higher prices, they receive more real honest-to-goodness money for them than the securities cost them. This leaves the Fed with more real honest-to-goodness money than it had before they bought those securities. It's analogous to your illustrative kid's finding a $20 bill in the street while running behind the bus - if he'd taken the bus, he wouldn't have come home with an extra $20. And since he owes his mother $200 for sneakers, his action reduced his deficit by 10%.

Originally Posted by Dennis D

Originally Posted by Dennis D

Enough aleady!

-

I'm not upset at all, and not surprised you didn't like the joke either.

Originally Posted by nevershouldhavesoldit

Originally Posted by nevershouldhavesoldit

Of course, it's all fun 'til the music stops.....Ask a Central Banker near you....

-

But!!! But!!! Hannity said the wokenistas are causing inflation buying lates, banning hamburgers, and driving Prius! Tucker Carlson asked why Biden took Mr Potato Head’s penis away knowing it would raise global oil prices! Laura Ingram told me that if “other” people hadn’t gotten pandemic support they didn’t deserve we would have $1.50/gal gas (obviously the money I got was necessarily and justified).

Originally Posted by nevershouldhavesoldit

Originally Posted by nevershouldhavesoldit

You must be one of those highly educated “elites” they keep warning us about with all your scary data, logic, research, and knowledge. I’m sorry, but I’m going to have to put you on my ignore list and check back in with Tucker. He’s so trustworthy even Russian state media replays his shows.

Sent from my iPhone using Tapatalk Pro

-

Rant of the day!

Originally Posted by rlrhett

Originally Posted by rlrhett

-

Who said I didn't like the joke? It reminded me of the difference between passive-aggressive and passive-dependent people. If you give your kid a dollar, send him to the store for a quart of milk, and he comes home with no milk and no dollar, he's passive dependent. If he comes home with a $1 Hershey bar, he's passive-aggessive

Originally Posted by Dennis D

Originally Posted by Dennis D

-

... and if he comes home with a quart of milk, he's a criminal, because he pocketed the dollar and swiped the milk, LOL.

Originally Posted by nevershouldhavesoldit

Originally Posted by nevershouldhavesoldit

It's at about $1.35 plus tax here.

-

I was going to ask if we had to adjust our gender assumptions for Woody

Originally Posted by Doctor Jeff

Originally Posted by Doctor Jeff

Now is clearly not the time to spring for a repurposed Towncar police cruiser or the Lancia equivalent of the Chrysler 300. I haven't seen LPG price evolution because the last pump that had it in my neighbourhood closed down a few years back. The E85 continues to to be very cheap though; I suppose more people (with recent gasoline engines) will be mixing at the pump.

My partner has a 2018 1.0TSI Skoda which cost less than 15k€ new (with scrapping trade-in of her old C3 and bonus for taking a diesel off the road). I myself had already planned to hold on to my 2009 diesel as long as possible - which seems to be getting less and less because of increasing restrictions as to where it can go. I don't see electric vehicles in our future ... if we have to give up long distance travel it'd be cheaper to get a couple of horses

-

It’s an old joke

Originally Posted by dogletnoir

Originally Posted by dogletnoir

-

One thing I found especially frustrating was the brutal dealer mark-up game. I was looking at getting a used Honda Pilot. $40,000 dollars total off-the-lot cost was my target. I quickly learned how bad that mark-up game has gotten.

I looked online and the car was advertised for $39,000, before taxes and other fees. I dropped in on the dealer and it was $48,500 total cost out the door. The biggest expense was the dealer mark-up!

Reply With Quote

Reply With Quote

Playing live and getting the best sound from the...

Yesterday, 02:08 PM in Guitar, Amps & Gizmos